The bipartisan Child Tax Credit expansion in the tax bill negotiated by Senate Finance Committee Chair Ron Wyden and House Ways and Means Committee Chair Jason Smith takes an important step toward making the credit work for children in families with low incomes. While smaller than the American Rescue Plan credit expansion that expired at the end of 2021, the proposal’s top priority is getting more of the credit to most of the roughly 19 million children who currently get a partial credit or none at all because their families’ incomes are too low. The bipartisan proposal pairs corporate and small business tax provisions with Child Tax Credit improvements that cost a similar amount, reportedly about $35 billion for each set of proposals. With the exception of a modest indexing proposal, all of the benefits from the Child Tax Credit improvements go to children left out of the full credit because their families’ incomes are too low.

The expansion would be in effect for three years. While modest in size, the proposal would have a significant impact. In the first year, more than 80 percent of the roughly 19 million children under 17 in families with low incomes who don’t now get the full credit would benefit — about 16 million children. This includes nearly 3 million children under age 3.

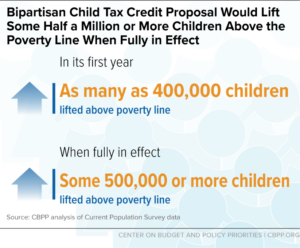

In the first year, the proposal would lift as many as 400,000 children above the poverty line and make an additional 3 million children less poor.

In the first year, the proposal would lift as many as 400,000 children above the poverty line and make an additional 3 million children less poor as their incomes rise closer to the poverty line. These poverty-reducing effects would increase over time. When the proposal is fully in effect in 2025, it would lift some half a million or more children above the poverty line and make about 5 million more less poor. This would mark the beginning of a much-needed reversal of the sharp rise in child poverty that occurred in 2022, following the expiration of the Rescue Plan expansion of the Child Tax Credit and other COVID relief measures.

The proposal would benefit children of all races and ethnicities. Overall, more than 1 in 5 children under 17 would benefit in the first year. The expansion would particularly help Black, Latino, and American Indian and Alaska Native (AIAN) children, whose parents are overrepresented in low-paid work due to historical and ongoing discrimination and other structural barriers to opportunity. More than 1 in 3 Black children, more than 1 in 3 Latino children, 3 in 10 AIAN children under 17, and roughly 1 in 7 white children and Asian children under 17 would benefit from the proposal.

The proposal would deliver a meaningful income boost to millions of families in the first year. For example, consider a parent who has a toddler and a second grader and earns $15,000 working as a food server. In the first year, the family’s Child Tax Credit would increase by $1,725, from $1,875 to $3,600.

Half of the roughly 16 million children who would benefit under the proposal in the first year live in families who would gain $630 or more. For nearly 40 percent of children who would benefit, their family’s gain would be $1,000 or more, and 25 percent of children are in families who would gain more than $1,400 in the first year. The gains for low-income families with more than one child — roughly three-quarters of children in low-income families are in this group — would be particularly large. Among children who live in families with more than one child and who would benefit, half are in families who would gain $1,000 or more in the first year. For families who don’t now get the full credit because their incomes are too low, the gains would be larger when the proposal is fully in effect in 2025.

To read more, click here.